Nach meiner drastischen Themen Änderung, ist für mich der nächste logische Schritt, eine Liste mit Apps an zu legen die bereits auf dem Markt existieren. Was können diese, wo liegen ihre stärken und schwächen und was sagen ihre Nutzer.

Schlagwort: interaction design

Financial Literacy in MobilePay Application.

Part I: About China

After extensive searches and surveys, I found that in the mobile payment applications design in China, we would consider more about the user experience design for most of the public, and very few for children. At the same time, I found that mobile payment applications designed specifically for children can also be significantly challenged in Chinese society. Why? There may be two reasons.

First,strong traditional thoughts and cultures, such as “The mind of the superior man is conversant with righteousness; the mind of the mean man is conversant with gain”, make the financial topic very sensitive. Therefore, our education about finance and money in the primary stage is very weak, and the public doesn’t know the importance of financial literacy.

Second, the mobile payments market is occupied by two company so that any who want to pursue a new children experience must meet the biggest challenge. Regarding market share, Alipay has 54% compared to 40% for WeChat Pay, according to iResearch Consulting Group.

But more and more companies and universities start to pay attention to optimise digital service for children. AliPay did a lot of work about education, but it doesn’t work well because, in Chinese people mind, AliPay is an absolute financial tool and improper for children. WeChat Pay looks simpler in financial aspect and attracts more children for its history in social platform and game industry.

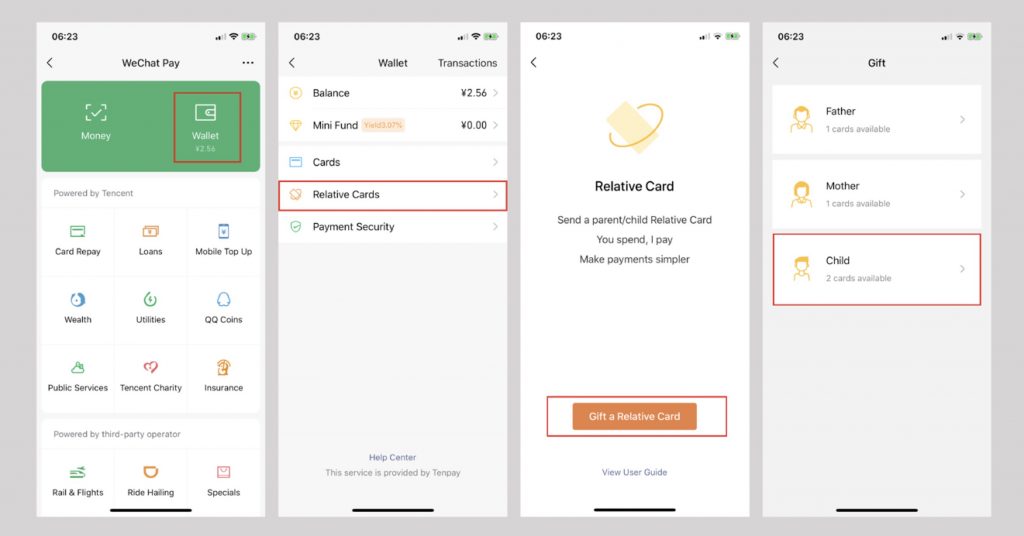

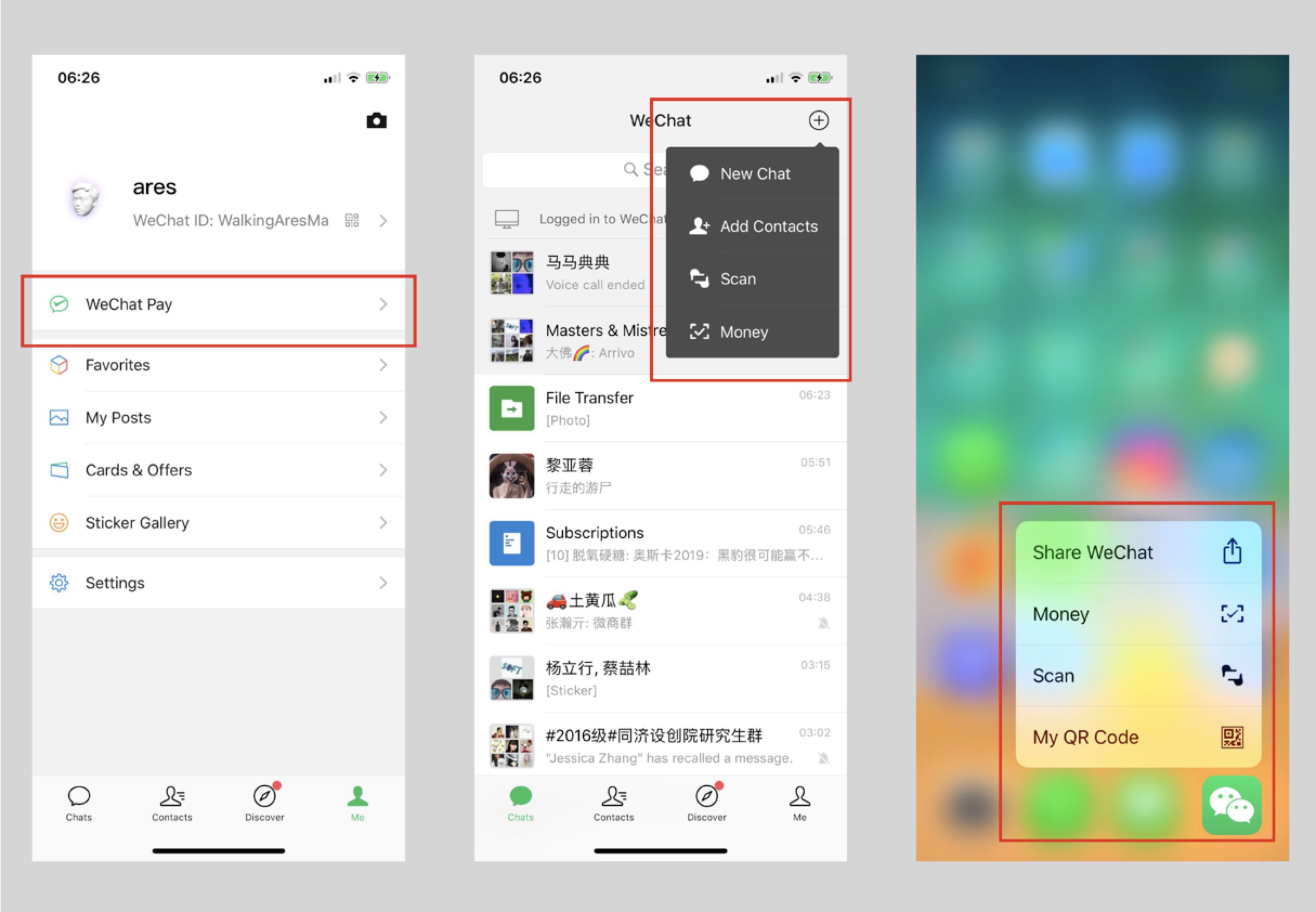

Basically, everyone who has WeChat can use WeChat pay, but The relative card in Wechat Pay offers an official way for children to use their mobile payment. This is the only specific way that children can use and parents can supervise in China.

Part II: About Europe and USA

In Europe and USA, The financial education system has matured, and the concept of children receiving financial education from an early age has been widely recognised by families, schools and society. Better education and better social recognition create more different mobile payment experience or financial experience for children.

“As society becomes cashless, making payments becomes as easy as tapping a card or pressing a button,” says Clint Wilson, founder of the Nimble app. “This can be convenient, but it can also be a problem. In the past, children would be able to tell how much they’d spent by how much their pocket jangled. Nowadays, it is easy to forget that each tap and press costs real money and can add up.”

The days of the piggy bank could be numbered. Instead of saving their pennies, children as young as four can now learn to manage their pocket money on digital budgeting apps. From age six, there are contactless cards which parents can load and monitor via their smartphones.

Some adults might shudder at the thought of such innovations, but in our increasingly cashless society, many believe they are a better way of teaching young children about money. Parents are the single biggest influence in shaping children’s attitudes towards money from a young age, but more than half say they lack the confidence or knowledge to teach their children to manage money according to Experian research.

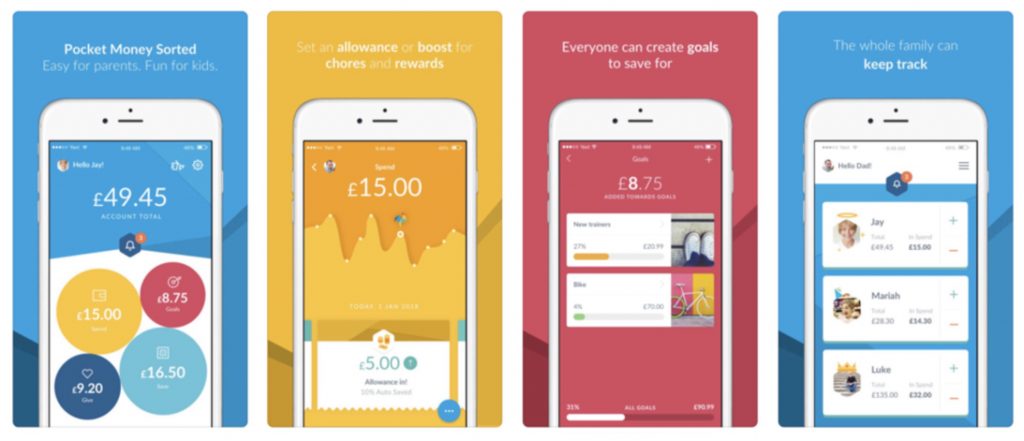

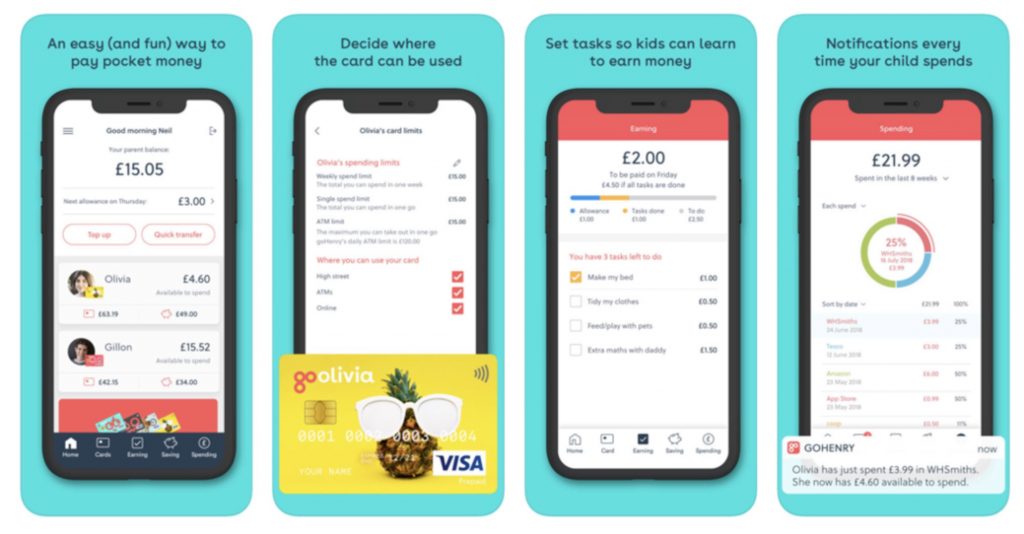

Unlike a conventional bank account, these app-based services appeal to parents who are keen to educate their children about the value of money but want to retain a margin of control over what their children do with their cash. For example, they might want to monitor their child’s purchases or restrict what they can spend on in-app purchases or digital downloads. It is also possible to set tasks — such as completing chores — for your child to complete to earn their pocket money.

I find two application below, the RoosterMoney is a financial education and management App for children, and the GoHenry can support children in using mobile payment.

Mobile payment in China and its effects on Children

Main Background in China on Mobile Internet.

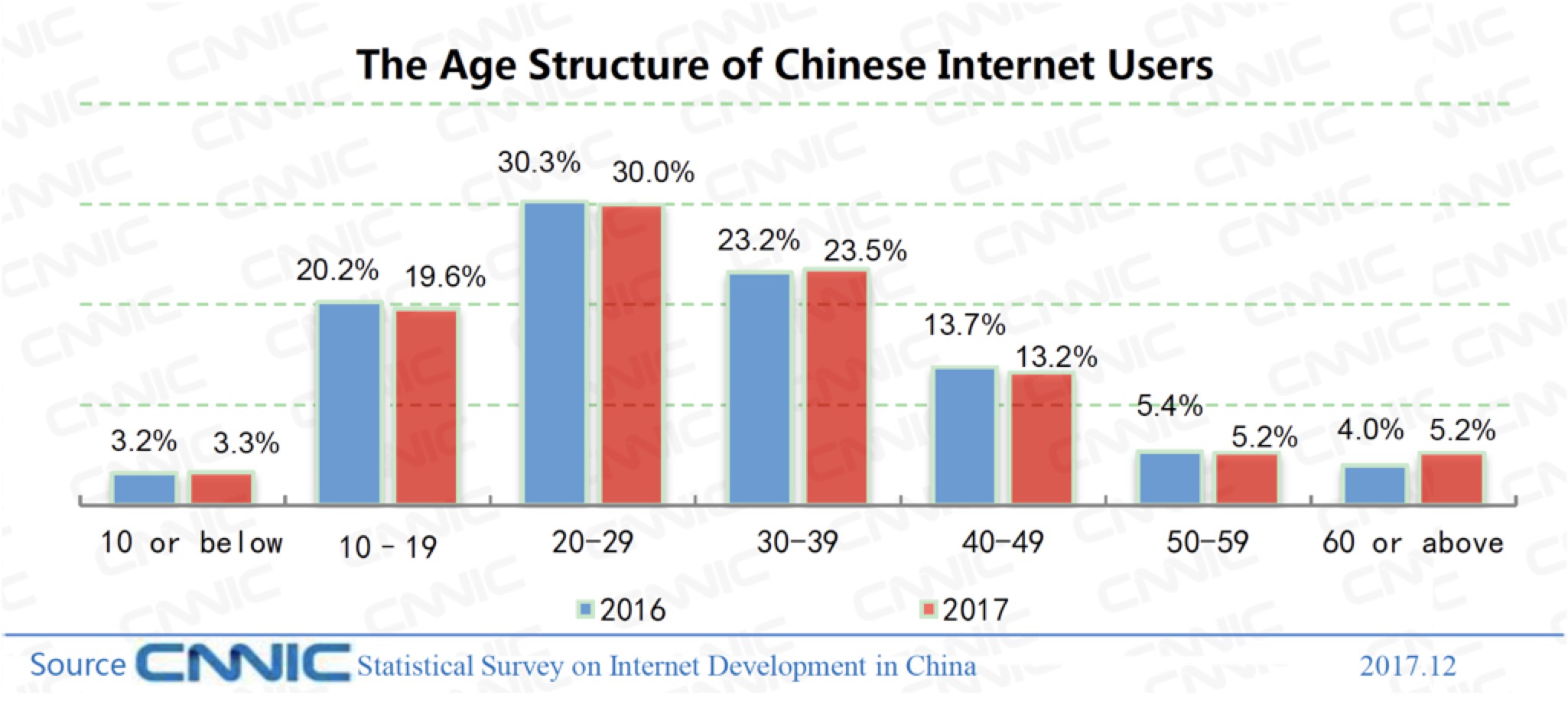

China had 772 million netizens by the end of 2017, with a penetration rate of 55.8 per cent, and 40.74 million more than the number in the previous year. Among them 753 million (97.5%) surfed the internet via mobile phones, 57.34 million more than the last year (95.1%), the report said.

Mobile social software has become an absolute necessity for mobile phone uses, with nearly half of them using this software more than three times each day. The top three most used social apps are WeChat Moments, Qzone and Sina Weibo, with the usage rate of 87.3 per cent, 64.4 per cent and 40.9 per cent respectively. This will be related to why I choose this topic.

Children’s scale of using the Internet

Up to June 2017, 72.1% of Chinese Internet users were aged 10-39. Specifically, 29.7% of Chinese netizens were aged 20-29, 19.4% aged 10-19 and 23.0% aged 30-39. We can calculate that the proportion of Children (below 12 years old) can be over 3.1%. There have over 23.9 million children that are surfing on the Internet.

Mobile Payment in China.

China had 531 million online payment users at the end of last year, 11.9 per cent or 56.61 million more than the previous year. Among them, 527 million people use mobile online payment, 12.3 per cent or 57.83 million more than the last year. Since the end of 2016, the proportion of internet users that pay with their phones offline rose from 50.3% to 65.5%.

Immense Contrast between popular mobile payment and small consideration for Children

In today’s China, online shopping and mobile payments have become a part of life. How to help children to deal with money in the digital world should be one of the most critical factors that designers must consider when designing digital payment experience. What’s more, the mobile payment is simultaneously connecting online and offline events, which makes developing mobile payment interaction and experience for children significant and vital.

Interaktionsmöglichkeiten bei Mixer

Nachdem ich die Wiedergabeseite von Twitch.tv aktualisiert habe., wird von mir heute die Wiedergabeseite von Mixer.com etwas genauer unter die Lupe genommen. Und hier sind auf dem 1. Blick deutlich mehr Funktion als bei twitch.tv erkennbar.

Die Wahl der Streaming Plattform!

Um das meiste aus der Streamer zu Zuschauer und Zuschauer zu Streamer Interaktionen herauszuholen ist es wichtig die richtige Plattform zu nutzen. In meinem letzten Post habe ich bereits die meist verbreitetsten Gaming Streamingdienste aufgezählt. Jede Plattform arbeite mit ihren eigenen Interaktionen, manche sind direkt über den Anbieter verfügbar, andere können über 3rd Party Anwendungen hinzugefügt werden, diese sind jedoch oft auf gewisse Plattformen ausgelegt. Aus diesem Grund werde ich mich im weiteren Verlaufes meines Research auf 2 Plattformen beschränken.

Wo streamt man eigentlich Videospiele?

Der Markt ist groß und viele versuchen mit zu mischen. In den letzen Jahren ist die Anzahl an Streamingdienste, um sein Videospiel-Erlebnis live zu streamen gestiegen. Doch nur einige haben sich wirklich durch gesetzt und haben eine Daseinsberechtigung.

Six Degrees of Gratification

GAMIFICATION OF ELECTIONS – PART 3

Gratification is one of the most powerful experiences of the psyche. It is often said, that patience is a virtue. Seeking gratification is the direct opposite: it is the satisfaction gained by successful short-term tactics and emotional impulses, rather than planned, deferred gratification which is obtained by achieving long-term goals. While the latter is a cornerstone in Strategy games – creating a game winning strategy from the very beginning, often times foregoing short-term gains – most other game genres pander to short-term achievements and instant rewards.

What is Gamification, and How Can I Avoid Use It?

GAMIFICATION OF ELECTIONS – PART 2

“Gamification is the use of features and concepts (e.g. points, levels, leader boards) from games in non-game environments, such as websites and applications, in order to attract users to engage with the product.”

—Macmillan Dictionary

So, what are those “features and concepts from games”? How do they work and with what purpose? While these features are present in basically every game there is (after all, they are what makes them a game) there are variations in their use.

Interaktionen in Gaming Live Streams

Livestreams bieten im Gegensatz zu Videos, Content Creator eine direktere Form der Interaktion mit ihren Zuschauern. Interaktionen können beispielsweise über einen Chat erfolgen oder über verschiedenen Erweiterungen erfolgen.

Streamer können in Echtzeit mit ihren Zuschauern interagieren und auf verschiedene Events die durch Zuschauern ausgelöst werden reagieren. Aufgrund der schnellen Entwicklung der verschiedenen Dienste wie Twitch, YouTube und co. und der immer größeren Verfügbarkeit von High-Speed-Internet, können Interaktionen nahezu in Echtzeit geschehen.