Part I: About China

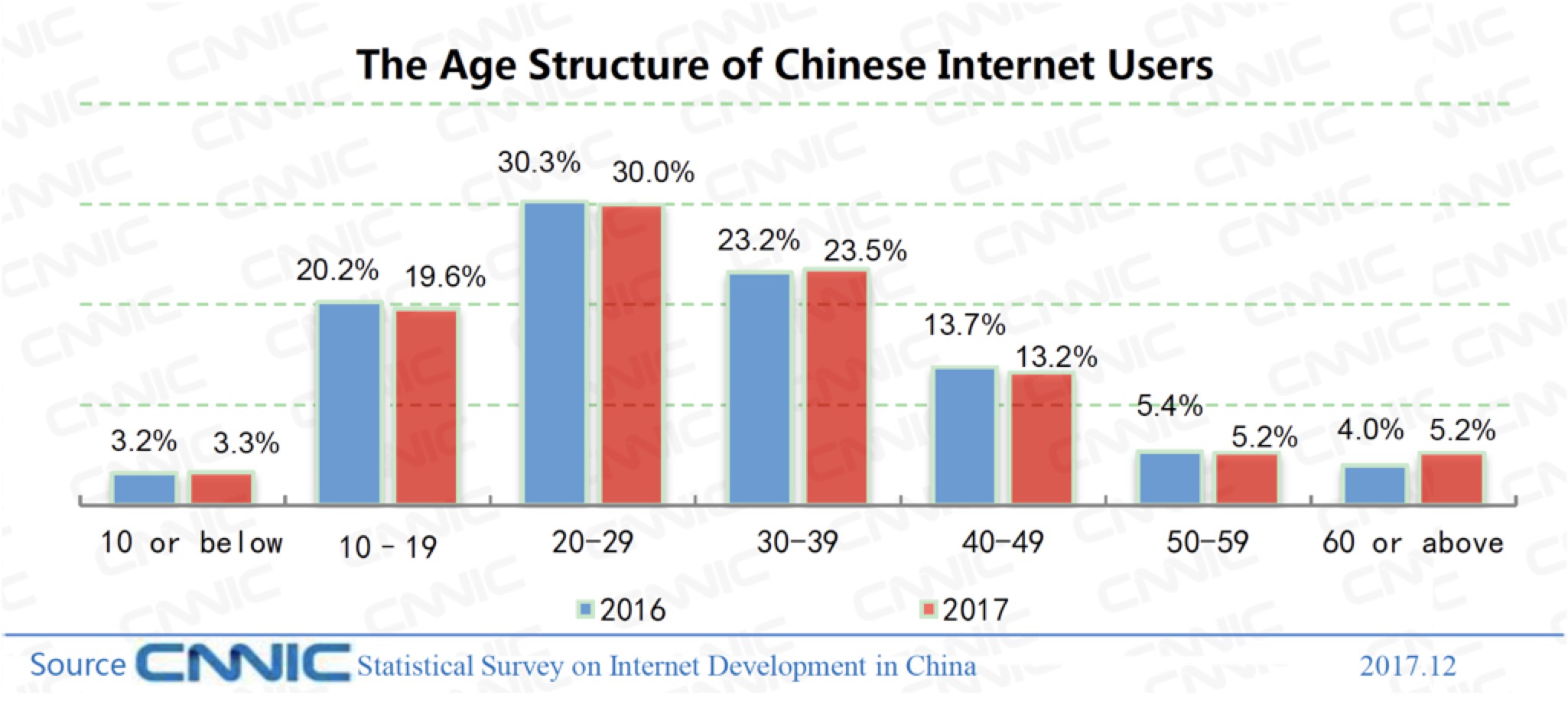

After extensive searches and surveys, I found that in the mobile payment applications design in China, we would consider more about the user experience design for most of the public, and very few for children. At the same time, I found that mobile payment applications designed specifically for children can also be significantly challenged in Chinese society. Why? There may be two reasons.

First,strong traditional thoughts and cultures, such as “The mind of the superior man is conversant with righteousness; the mind of the mean man is conversant with gain”, make the financial topic very sensitive. Therefore, our education about finance and money in the primary stage is very weak, and the public doesn’t know the importance of financial literacy.

Second, the mobile payments market is occupied by two company so that any who want to pursue a new children experience must meet the biggest challenge. Regarding market share, Alipay has 54% compared to 40% for WeChat Pay, according to iResearch Consulting Group.

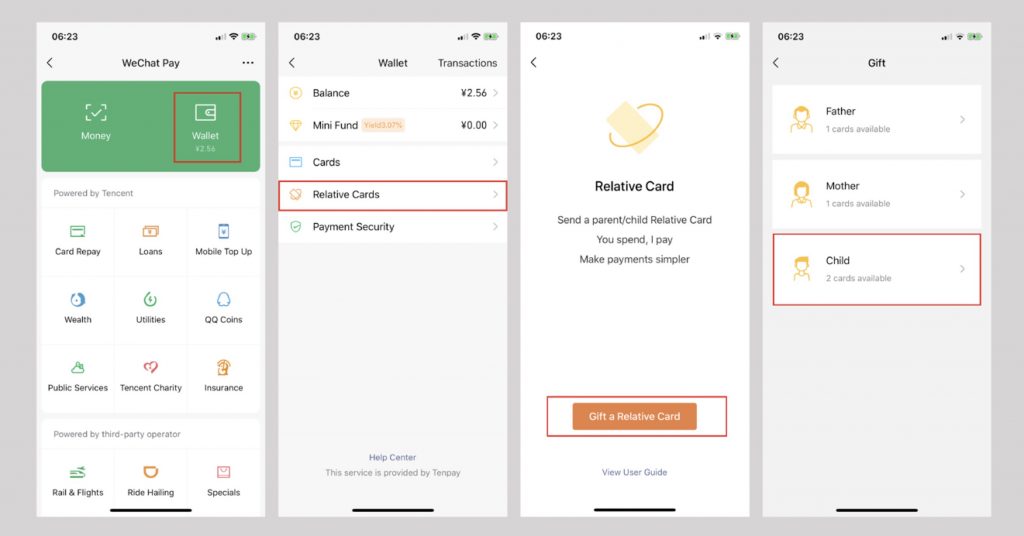

But more and more companies and universities start to pay attention to optimise digital service for children. AliPay did a lot of work about education, but it doesn’t work well because, in Chinese people mind, AliPay is an absolute financial tool and improper for children. WeChat Pay looks simpler in financial aspect and attracts more children for its history in social platform and game industry.

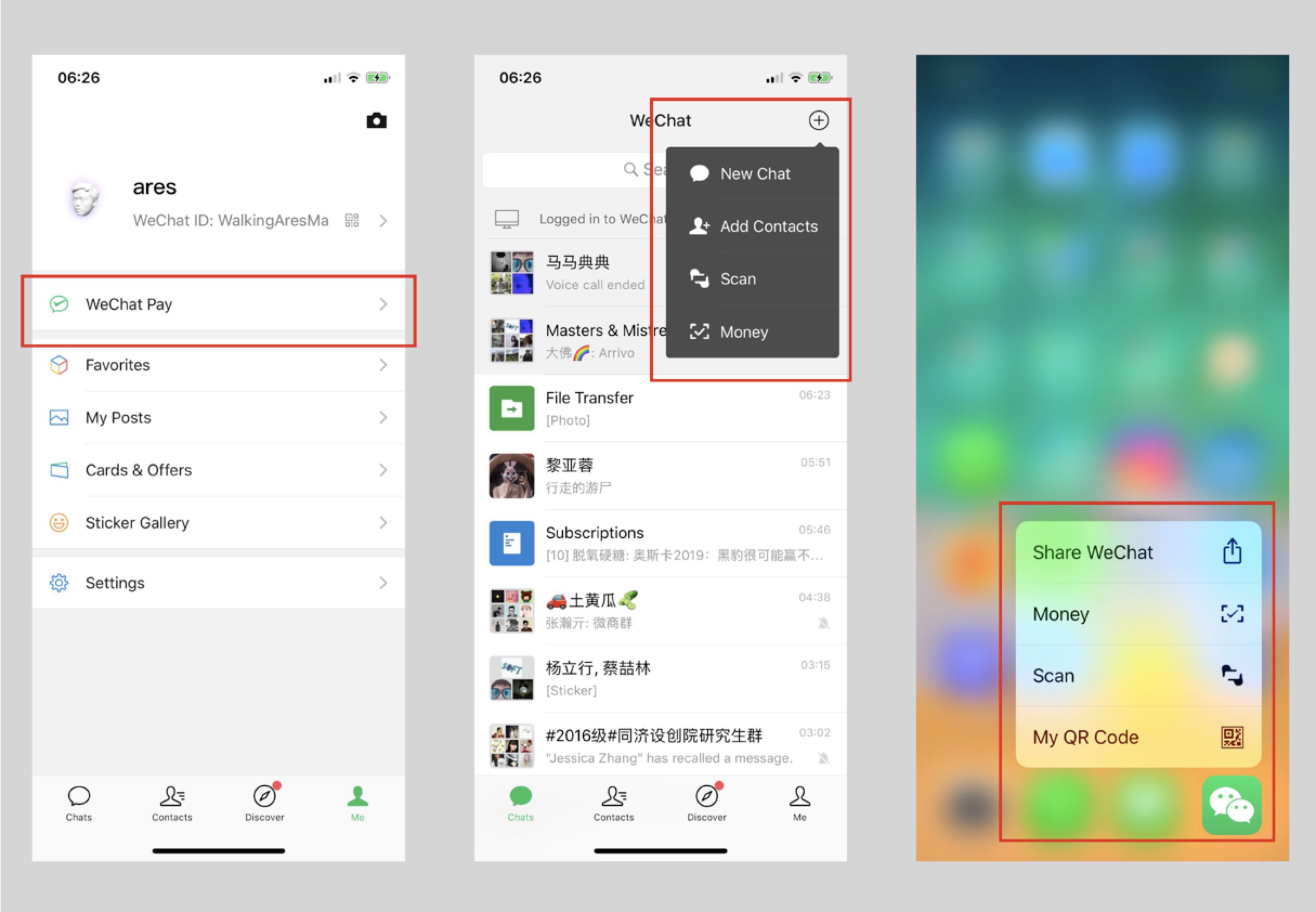

Basically, everyone who has WeChat can use WeChat pay, but The relative card in Wechat Pay offers an official way for children to use their mobile payment. This is the only specific way that children can use and parents can supervise in China.

Part II: About Europe and USA

In Europe and USA, The financial education system has matured, and the concept of children receiving financial education from an early age has been widely recognised by families, schools and society. Better education and better social recognition create more different mobile payment experience or financial experience for children.

“As society becomes cashless, making payments becomes as easy as tapping a card or pressing a button,” says Clint Wilson, founder of the Nimble app. “This can be convenient, but it can also be a problem. In the past, children would be able to tell how much they’d spent by how much their pocket jangled. Nowadays, it is easy to forget that each tap and press costs real money and can add up.”

The days of the piggy bank could be numbered. Instead of saving their pennies, children as young as four can now learn to manage their pocket money on digital budgeting apps. From age six, there are contactless cards which parents can load and monitor via their smartphones.

Some adults might shudder at the thought of such innovations, but in our increasingly cashless society, many believe they are a better way of teaching young children about money. Parents are the single biggest influence in shaping children’s attitudes towards money from a young age, but more than half say they lack the confidence or knowledge to teach their children to manage money according to Experian research.

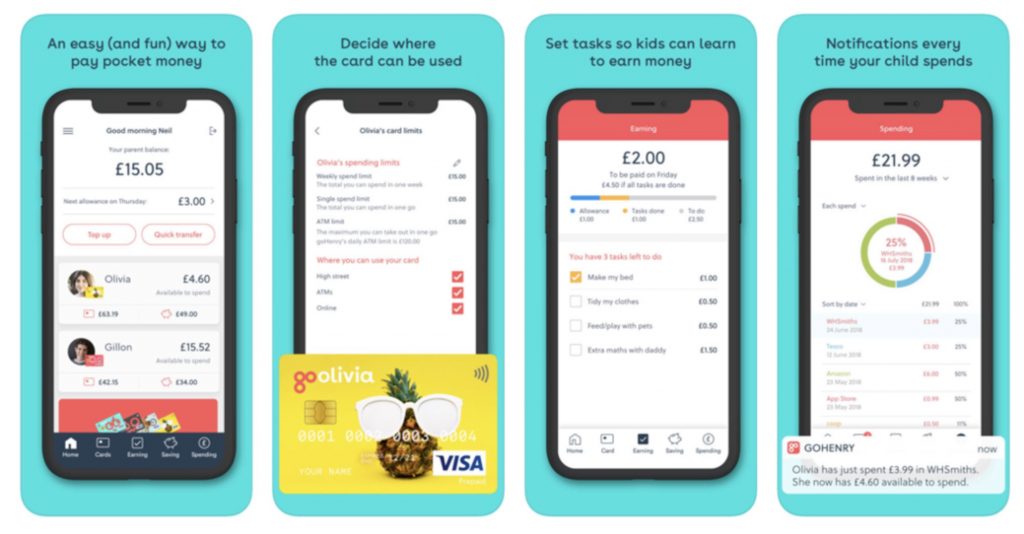

Unlike a conventional bank account, these app-based services appeal to parents who are keen to educate their children about the value of money but want to retain a margin of control over what their children do with their cash. For example, they might want to monitor their child’s purchases or restrict what they can spend on in-app purchases or digital downloads. It is also possible to set tasks — such as completing chores — for your child to complete to earn their pocket money.

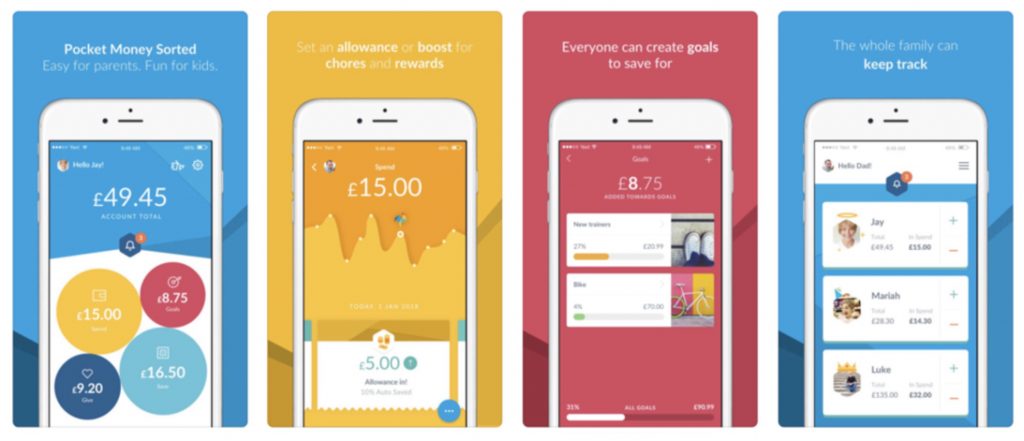

I find two application below, the RoosterMoney is a financial education and management App for children, and the GoHenry can support children in using mobile payment.